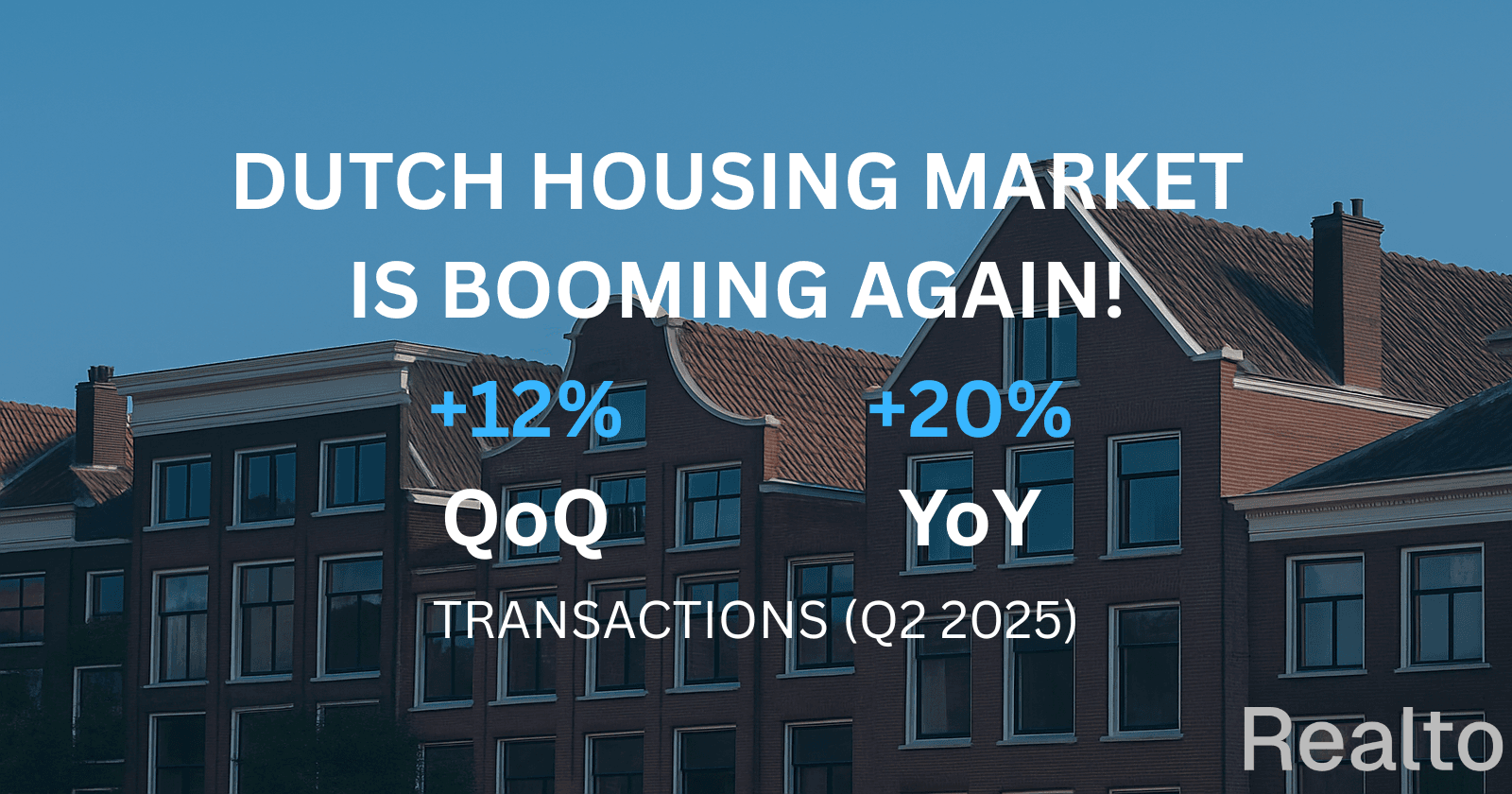

Dutch Housing Market Q2 2025: Transaction Boom Signals New Momentum

Realto

Published on Sunday, Sep 28, 2025

The Dutch housing market is buzzing again. After years of turbulence caused by rising interest rates, affordability challenges, and limited supply, Q2 2025 marked a clear turning point. The number of transactions rose by around 12% compared to Q1 2025 and by a striking 20% compared to the same quarter last year【DMFCO】.

This surge shows that buyer activity is back, but also that underlying structural dynamics like investor sell-offs, mortgage conditions, and tight supply are reshaping the market. In this blog, we’ll explore the data, dig into what’s driving these shifts, and look ahead at what might come next.

1. The Numbers: Transactions and Beyond

The transaction boom is part of a broader shift in the Dutch housing market. Let’s look at the headline figures:

| Metric | Q2 2025 / Change | Source |

| Total transactions (~57,400 homes) | +12% QoQ, +20% YoY | DMFCO |

| Mortgage volumes (~41 billion) | +11.8% QoQ, +29.2% YoY | DMFCO |

| House price index | +1.5% QoQ, +10.6% YoY | DMFCO |

| Average price growth (existing homes) | +9.3% YoY in June 2025 | CBS |

| New-build homes sold | 6.2k in Q2, +28% YoY | CBS |

| Transaction growth by type | Terraced +12.1%; Apartments +31% YoY | Calcasa |

2. Why Are Transactions Rising?

Several factors explain this sudden surge:

2.1 Investor Sell-Offs

A significant driver has been private landlords leaving the rental market. New regulations and tax changes have made buy-to-let less attractive. As a result, thousands of properties once rented out are now being sold.

- Dynamic Credit reports that 40% of transactions in the four largest cities were former rental properties【dynamiccredit.com】.

This means that buyers who were previously squeezed out by low supply are suddenly finding more homes available particularly in urban centers.

2.2 Mortgage and Financing Conditions

Mortgage volumes also rose sharply, up nearly 30% year-on-year【dmfco.nl】. Despite relatively high interest rates compared to the pre-2022 period, buyers seem to have adjusted:

Some lenders are tightening spreads, making mortgages slightly more affordable【dynamiccredit.com】.

Wage growth is helping households qualify for higher loan amounts【rabobank.com】.

2.3 Seasonal and Behavioral Factors

Spring and early summer are traditionally strong periods for housing activity. Families prefer to move before the new school year starts, adding a natural seasonal boost.

3. Regional and Property Type Differences

The growth is not uniform.

Apartments saw the largest jump in sales, with transactions up 31% YoY【calcasa.nl】. This aligns with the trend of rental properties being sold off.

Terraced houses also performed well, up 12% YoY.

New builds: CBS data shows sales of new-build homes rose 28% YoY, though volumes remain small compared to existing homes【cbs.nl】.

Geographically, the Randstad (Amsterdam, Rotterdam, The Hague, Utrecht) is leading the surge, but smaller towns are also benefiting from spillover demand.

🔍 Visual idea: Map showing year-on-year transaction growth by province.

4. House Prices: Still Climbing

Despite the increase in supply, prices continue to rise.

CBS reports that existing home prices in June 2025 were 9.3% higher than a year earlier【cbs.nl】.

DMFCO’s housing index shows a 10.6% YoY increase【dmfco.nl】.

Why? Because demand is still far greater than supply. The Netherlands faces a structural shortage of housing, estimated at over 300,000 homes. Even a wave of investor sell-offs isn’t enough to fully balance the market.

5. Risks and Caveats

While Q2 2025 looks positive, several risks remain:

Affordability pressure: Prices are rising faster than many incomes, limiting how long this momentum can last.

Interest rate sensitivity: If the ECB raises rates again, mortgage demand could cool quickly.

Supply bottlenecks: New-build construction remains constrained by nitrogen rules, permit delays, and high building costs【dynamiccredit.com】.

Temporary effect of investor sell-offs: Once the current wave of landlords exits, supply may tighten again.

6. Outlook for 2025 and Beyond

Most forecasts now expect double-digit transaction growth for the full year 2025.

ABN AMRO projects transactions to rise ~12.5% in 2025【abnamro.com】.

Rabobank foresees continued upward pressure on prices, though at a slower pace if supply stabilizes【rabobank.com】.

Looking further ahead, the main challenge is structural: unless the Netherlands dramatically increases housing construction, scarcity will keep prices elevated.

7. Takeaways for Buyers, Sellers, and Policymakers

For buyers: Competition is heating up again. Expect quicker sales and more bidding wars in urban areas.

For sellers: Now may be an excellent time to list, as rising demand meets still-limited supply.

For policymakers: The investor sell-off trend shows regulation works, but it may reduce rental supply. Balancing affordability in both owner-occupied and rental markets will be key.

Conclusion

Q2 2025 marks a turning point in the Dutch housing market: transactions are surging, mortgage demand is strong, and prices continue to rise. Yet, this momentum rests on fragile foundations. Structural shortages, affordability challenges, and the temporary boost from landlord sell-offs.

For now, the market feels vibrant again, but the real question is: how sustainable is this boom?